2022

Developed a strategy to improve Amazon’s reputation and make a stronger bond with local businesses who are the most affected by the increase of online shopping.

ROLE

UX Researcher/ UX Strategist

TASKS

user research, data analysis, UX strategy

PROJECT DURATION

4 weeks

READ TIME

5 min

The process

01. Project overview

02. Research approach

03. Findings

04. Strategic UX

05. Final takeaways & next steps

1. Project overview

Evaluation of the project briefing and main objectives with exploratory research to identify problems and create a hypothesis.

1.1 Context

Amazon, as the world’s leading e-commerce platform, faces public perception challenges regarding sustainability and ethical practices. Despite their market leadership and diverse service offerings, they struggle with maintaining a positive image in these areas.

1.2 Problem statement

Amazon’s sustainability initiatives and local business support programs lack visibility and user trust, particularly in their Amazon Handmade platform and local commerce initiatives.

Business challenge

- Divided public opinion on sustainability practices vs. greenwashing

- Perception issues regarding worker rights and discrimination

- Concerns about product monopolization

- Low visibility of sustainable and local business initiatives

Goals

- Improve Amazon’s reputation through sustainable practices

- Adapt platform for sustainability-conscious users

- Better support local businesses and artisans

- Align platform services with sustainable and ethical values

2. Research approach

2.1 Methodology

DESK RESEARCH

To explore discussions in forums, social media, and industry reports on sustainable e-commerce trends.

SURVEYS AND SEMI-STRUCTURED INTERVIEWS

To gather insights on shopping behaviors and perceptions of Amazon’s sustainability efforts.

COMPETITIVE ANALYSIS

To compare Amazon Handmade with competitors like Etsy.

SEMI STRUCTURED INTERVIEWS

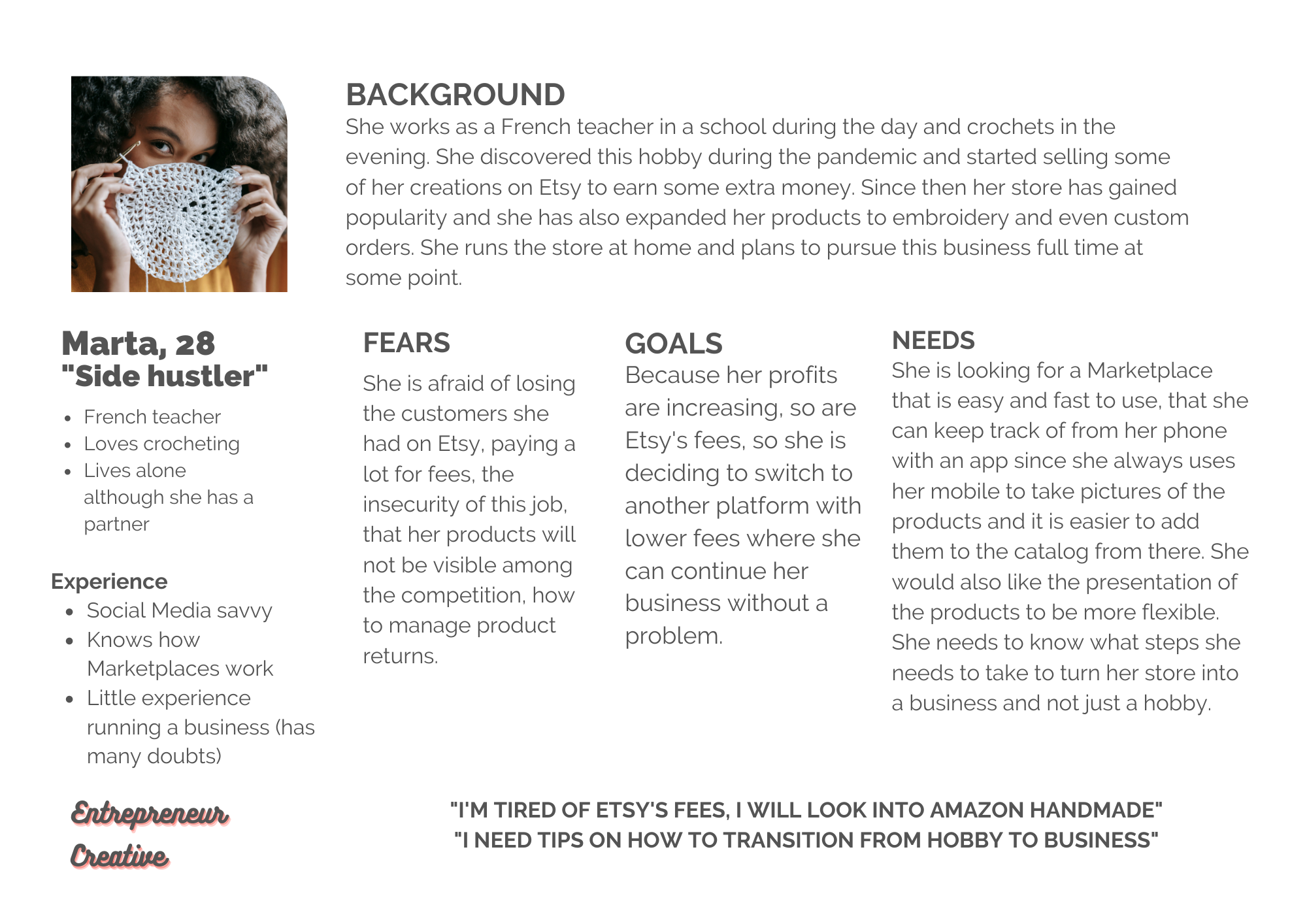

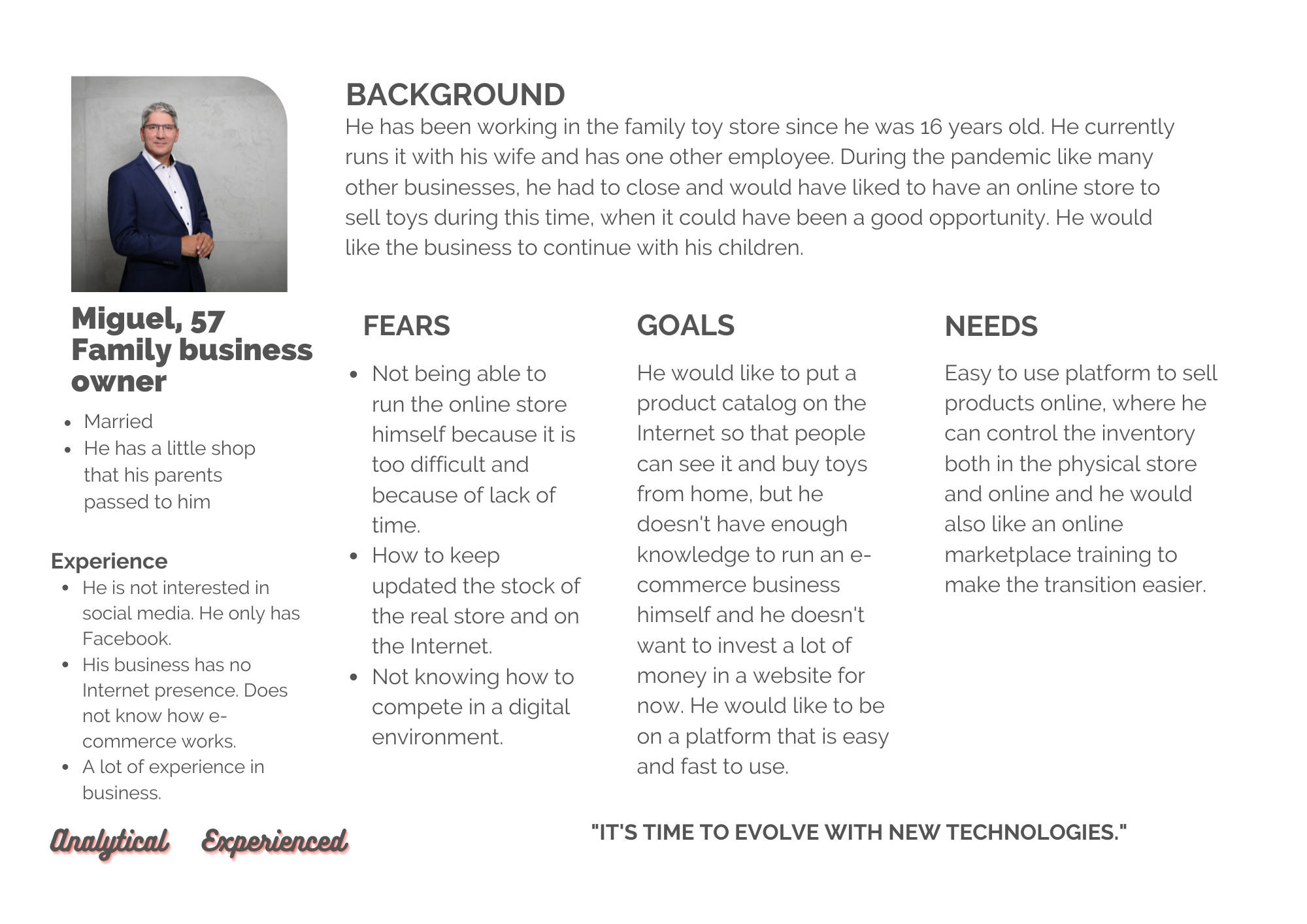

2.2 Target users

Current Amazon customers

(sustainability conscious and indifferent buyers)

Former Amazon customers (and switched to competitors)

Small business owners & independent sellers (potential Handmade sellers)

Environmental consciousness

According to a study conducted by Ipsos, Hotware Spain and Wallapop, “La Red del Cambio” (2021), Gen Z are the most environmentally conscious.

- 56% Z Gen

- 52% Baby Boomers

- 50% Gen X

- 48% Millennials

2.3 User personas

2.4 Research questions

- Why do users choose or leave Amazon?

- How is Amazon perceived regarding sustainability?

- What common problems do users face?

- Are users aware of and using Amazon Handmade?

- How do sellers perceive Amazon?

3. Key findings

- Users don’t trust Amazon’s sustainability efforts and believe they are just a marketing strategy.

- 56% of Gen Z and 52% of Baby Boomers are most conscious about environmental impact, but still shop on Amazon for convenience.

«Many companies invent certificates that say absolutely nothing.”

“I don’t think we can trust companies because they are always going to be looking for profitability.”

Convenience

Product variety

Lower prices

“There are simply no good alternatives. Funnily enough the market in recent years has begun to favor socially conscious companies, but no socially conscious company can have the broad reach fast turn around time, price of Amazon”

- Sustainability ranked lowest compared to price, shipping, and customer service.

“I always try not to buy from Amazon when the alternative is more or less easy.«

- 90% of surveyed users didn’t know Amazon Handmade exists.

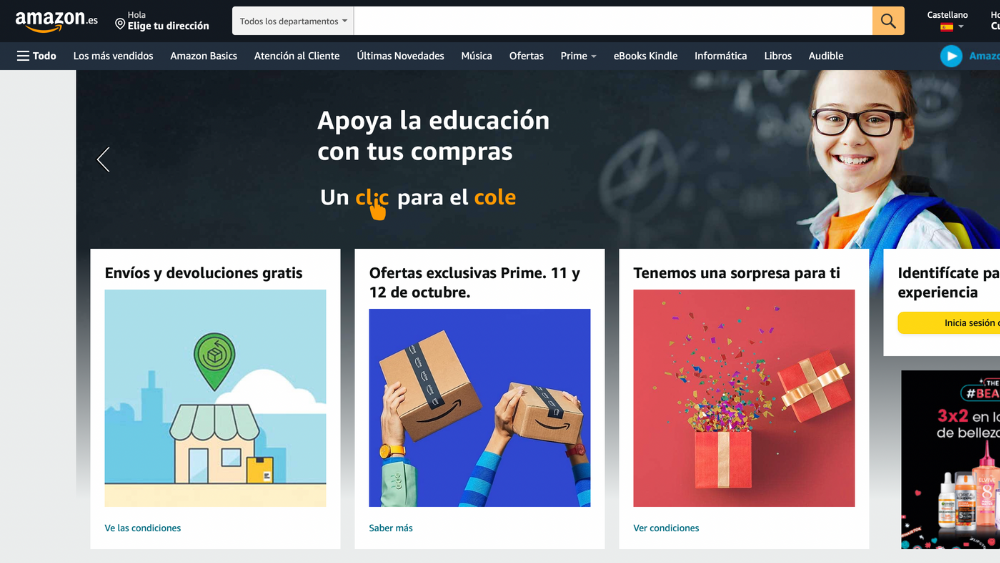

- Handmade products are hidden in deep menus, making them difficult to find.

- Users associate sustainability with local businesses, but Amazon doesn’t highlight its small business sellers.

- High commissions & competition make it difficult for sellers to remain profitable.

- Many sellers struggle with visibility as Amazon prioritizes its own products.

- Onboarding & usability issues: Many small sellers lack digital expertise and find Amazon’s seller experience complex.

High commission rates

Digital knowledge gaps

Limited product visibility

Time-consuming product listing process

Minimal consumer interaction

Product counterfeiting issues

Competitive analysis

| Feature | Amazon Handmade | Etsy | eBay |

|---|---|---|---|

| Seller support | Limited | Moderate | Moderate |

| Visibility | Low | High | Moderate |

| Fees | High | Moderate | Low |

| User Trust | Low | High | Moderate |

4. UX strategy

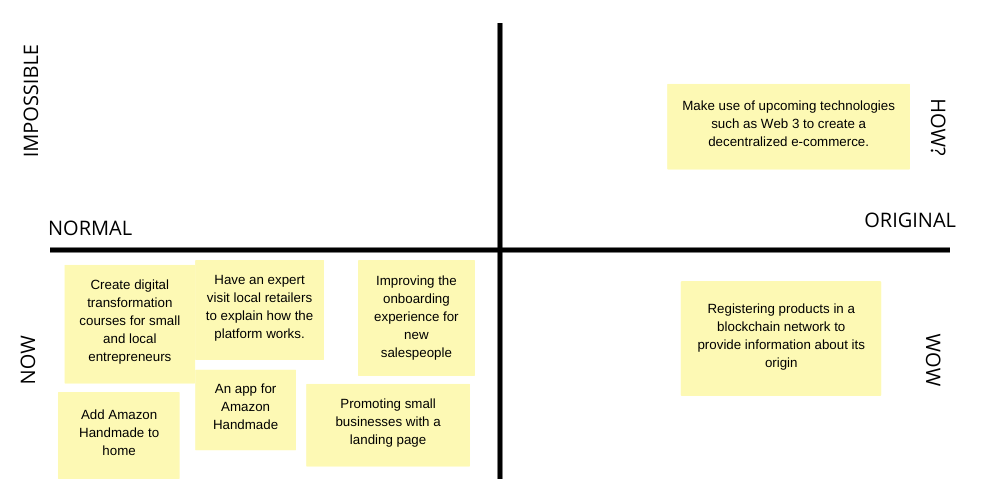

Ideation Matrix (How-Now-Wow)

| HOW: Future innovation | Blockchain for product authenticity |

| NOW: Quick win | Improving Amazon Handmade visibility |

| WOW: High Impact, medium effort | Working on a seller onboarding app |

Kano analysis: what users expect vs. delightful features

| Feature | Expectation |

|---|---|

| Chat with customers | Basic expectation |

| Mobile-friendly product listing | Performance |

| Blockchain transparency | Exciter |

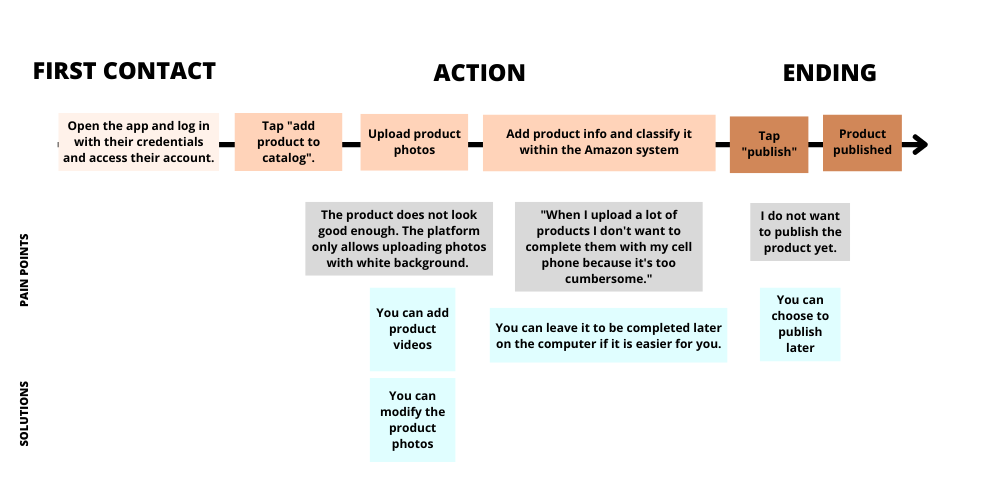

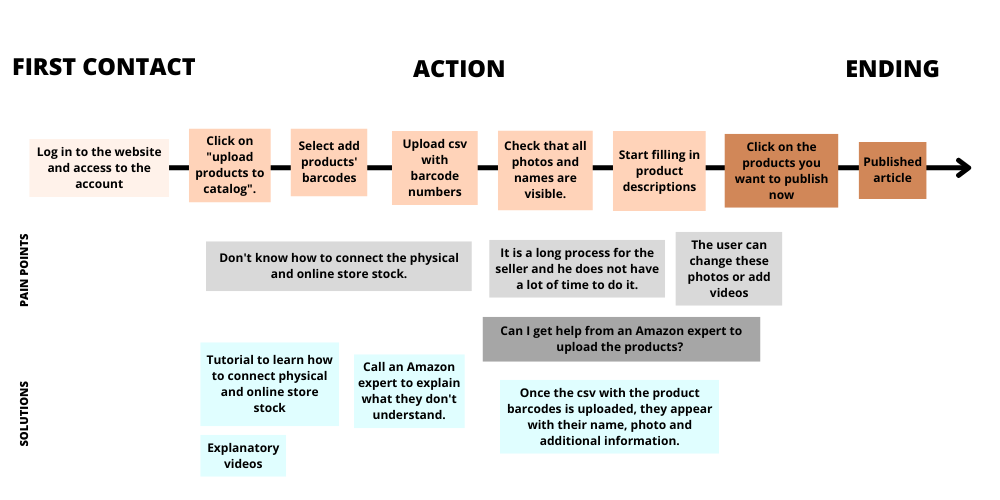

Customer journey map

Independent creative

Local business

5. UX solutions & impact

AMAZON IN OTHER COUNTRIES: INDIA

Amazon program to encourage local businesses to sell their products on the marketplace.

“Smart Commerce” program, helps to digitize small businesses that are totally unknown online.

What would I do differently now?

- If I had access to a different type of data from Amazon, I would have gotten data on how users arrive at the «Amazon Handmade» page. Explore the user journey and test its current effectiveness vs. the version with «Amazon Handmade» promoted on the home page. Would they be interested in it?

- Also, I would have loved to get access to the Amazon searches on «handmade» or in Spanish «hecho a mano», which in this case would be the most accurate one. That would be very useful to see the level of interest of Amazon users for that type of product and also to create categories within Amazon Handmade for a better experience.

- I would have interviewed small local commerces who sell their products on Amazon to better understand the pain points they experience during their user journey. In this case, I used the pain points signaled by the news article which was very helpful as well.